Table Of Contents

What is EV to EBITDA?

EV (which is the sum of market capitalization, preferred shares, minority shares, debt minus cash) to EBITDA is the ratio between enterprise value and Earnings Before Interest, Taxes, Depreciation, and Amortization that helps the investor in the valuation of the company at a very subtle level by allowing the investor to compare a certain company to the parallel company in the industry as a whole, or other comparative industries.

EV to EBITDA Multiple is a vital valuation metric used for measuring the value of the company to compare its valuation with similar stocks in the sector. It is calculated by dividing its enterprise value (Current Market Cap + Debt + Minority Interest + preferred shares – cash) by EBITDA (earnings before interest, taxes, depreciation, and amortization).

I rate this multiple above PE Ratio! The values of EV and EBITDA are used to find the EV/EBITDA ratio of an organization. This metric is widely used to analyze and measure an organization's ROI, i.e., return of investment and its value.

We note that the EV to EBITDA Multiple of Amazon is at around 29.6x, whereas for Walmart, it is around 7.6x. Does this mean that WallMart is trading cheap, and we should buy Walmart compared to Amazon?

In this detailed article on EV to EBITDA ratio, we look at the following topics –

Key Takeaways

- The EV-to-EBITDA ratio is a valuable metric for investors aiming to gauge a company's valuation. By comparing its enterprise value with Earnings Before Interest, Taxes, Depreciation, and Amortization.

- A lower EV/EBITDA ratio suggests potential undervaluation, whereas a higher ratio raises overvaluation concerns, thus guiding investment decisions.

- Enterprise value emerges as a strategic tool for identifying prospects in mergers and acquisitions. The EV/EBITDA ratio assumes significance in this context, acting as a reliable gauge for takeover potential.

What is Enterprise Value?

Enterprise Value, or EV, shows a company's total valuation. EV is used as a better alternative to market capitalization. The value calculated as the Enterprise Value is considered better than market capitalization because it is calculated by adding more vital components to the market capitalization value. The added components used in the EV calculation are debt, preferred interest, minority interest, and total cash and cash equivalents. The debt, minority interest, and preferred interest values are added with the calculated market capitalization value. At the same time, the total cash and cash equivalents are subtracted from the calculated value to get the Enterprise Value (EV).

We can thus write a basic formula for calculating the EV as follows:

EV = Market Cap + Debt + Minority Interest + Preference Shares - Cash & Cash Equivalents.

Theoretically, the calculated enterprise value can be considered the price or value an investor buys the company. The buyer will also have to take up the organization's debt as his responsibility in such a case. In other words, it is said that the particular value will be pocketed by him too.

The inclusion of debt gives the Enterprise Value its added advantage for organization value representation. The debt is to be considered seriously when it comes to any takeover situation.

For example, it will be more profitable to acquire an organization with a market capitalization of $10 million with no debt than to acquire an organization with the same market capitalization and a debt of $5 million. Apart from the debt, the enterprise value calculations also include other important special components in arriving at an accurate figure for the firm's value.

Also, you can have a look at the critical differences between Enterprise Value vs. Market Capitalization.

EV to EBITDA Explained in Video

Understanding EBITDA

EBITDA, or earnings before interest, taxes, depreciation, and amortization, is used to represent an organization's financial performance. With the help of this, we can find out the potential of a particular firm in terms of the profit its operations can make.

We can write the formula for EBITDA in simple terms as follows:

EBITDA = Operating Profit + Depreciation + Amortization

Here, the operating profit equals the net profit, interest, and taxes added together. The depreciation expense and amortization expense play a significant role in EBITDA calculation. So to understand the term EBITDA to the fullest, these two terms are explained in brief below:

- Depreciation: Depreciation is an accounting technique for allocating the cost of a tangible asset over its useful life. Businesses depreciate their long-term assets for both tax and accounting purposes. Businesses deduct the cost of the tangible assets they purchase as business expenses for tax purposes. But, businesses should depreciate these assets following IRS rules regarding how and when the deduction could be made.

- Amortization: Amortization can be explained as the paying off debt with a fixed repayment schedule, in regular installments, over a particular amount of time. It additionally refers to the spreading out of capital expenses for intangible assets, over a particular period, again for accounting and tax purposes. Two common examples of this are a mortgage and an automobile loan.

EBITDA is net income with interest, taxes, depreciation, and amortization further added back to it.

EBITDA may be employed to analyze and compare the profitability of different organizations and industries as it eliminates the effects of financing and accounting decisions. EBITDA is commonly utilized in valuation ratios compared to enterprise worth and revenue.

EBITDA is a Non-GAAP measure and is reported and used internally to measure the company's performance.

source: Vodafone.com

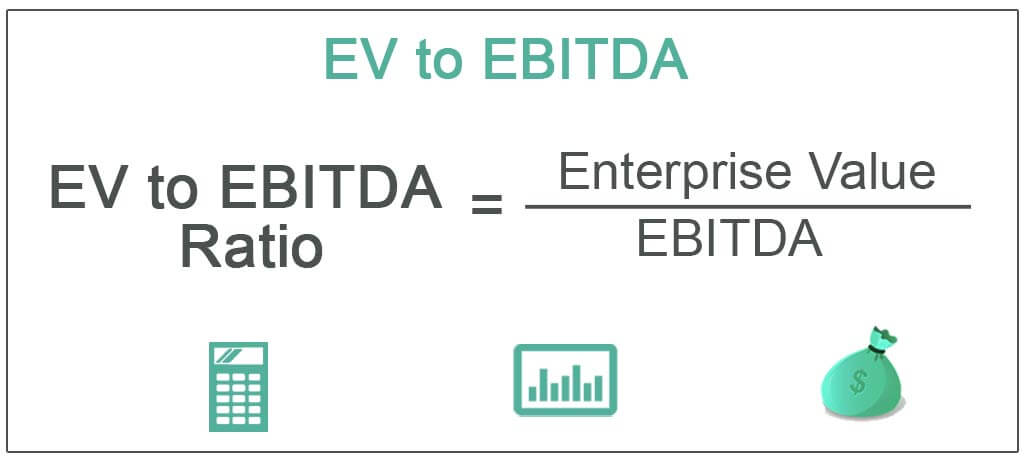

EV to EBITDA ratio or the Enterprise Multiple

Now that we know about EV and EBITDA, we can look at how they are used to get the EV/EBITDA ratio or, in other words, the Enterprise Multiple. The EV/EBITDA ratio looks at a firm as a potential acquirer would, considering the company's debt, which alternative multiples, like the price-to-earnings (P/E) ratio, don’t embrace.

The following formula can calculate it:

Enterprise value Formula = Enterprise Value / EBITDA

EV to EBITDA - Forward vs. Trailing

EV to EBITDA can be further subdivided into Investment Banking Analysis.

- Trailing

- Forward

Trailing EV to EBITDA formula (TTM or Trailing Twelve Months) = Enterprise Value / EBITDA over the previous 12 months.

Likewise, the Forward EV to EBITDA formula = Enterprise Value / EBITDA over the next 12 months.

The key difference here is the EBITDA (denominator). We use the historical EBITDA in the trailing EV to EBITDA and the forward or EBITDA forecast in the forward EV to EBITDA.

Let us look at the example of Amazon. Amazon's trailing multiple is at 29.58x; however, its forward multiple is around 22.76x.

source: ycharts

Calculating EV to EBITDA (Trailing & Forward)

Take the example below and calculate the Trailing and forward EV/EBITDA. The table is a typical comparable table with relevant competitors listed and their financial metrics.

Let us calculate EV to EBITDA for Company BBB.

Enterprise Value Formula = Market Capitalization + Debt - Cash

Market Capitalization = Price x number of Shares

Market Capitalization (BBB) = 7 x 50 = $350 million

Enterprise Value (BBB) = 350 + 400 -100 = $650 million

Trailing Twelve Month EBITDA of BBB = $30

EV to EBITDA (TTM) = $650 / $30 = 21.7x

Likewise, if we want to find the forward multiple of BBB, we need the EBITDA forecasts.

EV to EBITDA (forward – 2017E) = Enterprise Value / EBITDA (2017E)

EV to EBITDA (forward) = $650 / 33 = 19.7x

There are some points to consider concerning Trailing EV to EBITDA vs. Forwarding EV to EBITDA.

- If EBITDA is expected to grow, the Forward multiple will be lower than the Historical or Trailing multiple. From the above table, AAA and BBB show an increase in EBITDA, and hence, their Forward EV to EBITDA is lower than the Trailing PE.

- On the other hand, if EBITDA is expected to decrease, you will note that the Forward EV to EBITDA multiple will be higher than the Trailing multiple. It can be observed in Company DDD, whose Trailing EV to EBITDA was at 21.0x; however, Forward EV to EBITDA increased to 26.3x and 35.0x in 2017 and 2018, respectively,

- One should not only compare the Trailing multiple for valuation comparison between the two companies but also look at the Forward multiple to focus on Relative Value – whether the EV to EBITDA difference reflects the company’s long-term growth prospects and financial stability.

How to Find Target Price using EV to EBITDA

Now that we know how to calculate EV to EBITDA let us find the stock's Target Price using this EV to EBITDA multiple.

We revisit the comparable comp table we used in the earlier example. We need to find the fair value of TTT that operates in the same sector as below.

We note that the average multiple of this sector is 42.2x (Trailing), 37.4x (forward – 2017E), and 34.9x (forward – 2018E). We could directly use these multiples to find the fair value of the Target Company (YYY).

However, we note that company FFF and GGG are outliers with EV to EBITDA multiple ranges too high. These outliers have dramatically increased the overall EV to EBITDA multiple in the sector. Using these averages will lead to incorrect and higher valuations.

The right approach would be to remove these outliers and recalculate the EV to EBITDA multiple. We will remove any impact from these outliers, and a comparative table will be cohesive.

Recalculated average multiples of this sector are 19.2x (Trailing), 18.5x (forward – 2017E), and 19.3x (forward – 2018E).

We can use these multiples to find the Target Price of YYY.

- EBITDA (YYY) is $50 million (ttm)

- EBITDA (YYY) is $60 million (2017E)

- Debt = $200 million

- Cash = $50 million

- Debt (2017E) = $175 million

- Cash (2017E) = $75 million

- Number of Shares is 100 million

Target Price (based on trailing multiple)

- Enterprise Value (YYY) = Sector Average x EBITDA (YYY)

- Enterprise Value (YYY) = 19.2 x 50 = $ 960.4 million.

- Equity Value = Enterprise Value - Debt + Cash

- Equity Value (YYY) = 960.4 - 200 + 50 = $ 810.4 million

- Fair Price x Number of Shares = $810.4

- Fair Price = 810.4/100 = $8.14

Target Price (based on forward multiple)

- Enterprise Value (YYY) = Sector Average x EBITDA (YYY)

- Enterprise Value (YYY) = 18.5 x 60 = $ 1109.9 million.

- Equity Value (2017E) = Enterprise Value - Debt (2017E) + Cash (2017E)

- Equity Value (YYY) = 1109.9 - 175 + 75 = $1009.9 million

- Fair Price x Number of Shares = $1009.9 million

- Fair Price = 1009.9 /100 = $10.09

The following image shows an example of target price computation utilizing EV to EBITDA:

Image Source: Financial Modeling and Valuation Course Bundle

Why EV to EBITDA is better than PE ratio?

EV to EBITDA is better in many ways that the PE ratio.

#1 – Accounting can game PE ratios; however, the Gaming of EV to EBITDA is problematic!

It will become obvious with the help of an example.

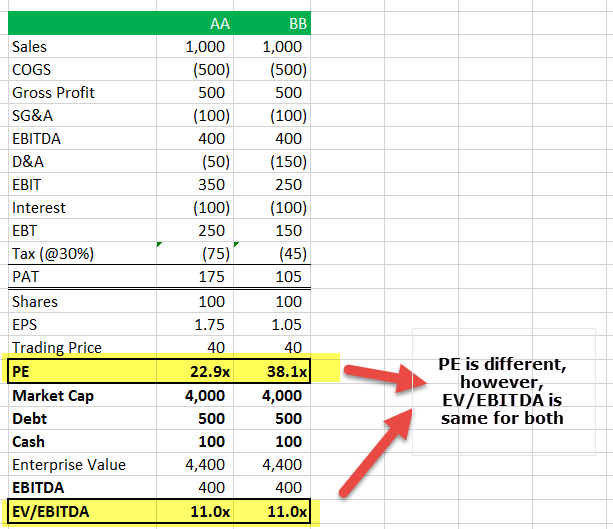

There are two companies – AA and BB. We assume that both companies are identical in all ways (Business, Revenue, clients, competitors). Though this is impossible in the practical world, we assume this impractical assumption for this example.

We also assume the following -

- Current Share Price of AA and BB = $40

- Number of Shares Outstanding of AA and BB = 100

In this case, you should not have any particular preference to buy a specific stock as the valuations of both the companies should be the same.

Introducing a slight complication here! Though all parameters are equal, we make only changes concerning the depreciation policies used by each company. AA follows a Straight Line Depreciation Policy, and BB follows an accelerated depreciation policy. Straight-line charges equal depreciation over the useful life. Accelerated Depreciation policy charges higher depreciation in initial years and lower depreciation in final years.

Let us see what happens to their valuations?

As noted above, the PE ratio of AA is 22.9x, while the PE ratio of BB is 38.1x. So which one will you buy?

Given this information, we favor AA as its PE multiple is lower. However, our assumption that these two companies are identical twins and should command the same valuations is challenged because we used PE Ratio. It is one of the most significant limitations of the PE ratio.

This huge valuation problem is solved by EV to EBITDA.

Let us now look at the table below -

We note that the Enterprise value of AA and BB are the same (this is the core assumption of our example). The table above notes that the enterprise value is $4,400 million (for both).

Though PAT for AA and BB was different, we note that the depreciation policy used does not affect EBITDA. AA and BB have the same EBITDA of $400.

Calculating EV to EBITDA (AA & BB) $4400 / $400 = 11.0x

We note that the EV/EBITDA of both AA and BB is the same at 11.0x and is following our core assumption that both companies are the same. Therefore it doesn't matter which company you invest in!

#2 - Buybacks affect PE Ratio

PE ratio is inversely proportional to the Earnings Per Share of the company. If there is a buyback, then the total number of shares outstanding reduces, thereby increasing the company's EPS (without any changes in the fundamentals of the company). This increased EPS lowers the PE ratio of the company.

Though most companies buyback shares as per the Share Buyback Agreement, one should be mindful that the management can adopt such measures to increase EPS without any positive change in the company's fundamentals.

Significance of Enterprise Multiple

- Investors primarily use an organization's EV/EBITDA ratio to determine whether a company is undervalued or overvalued. A low EV/EBITDA ratio value indicates that the particular organization may be undervalued, and a high EV/EBITDA ratio value indicates that the organization may well be overvalued.

- An EV/EBITDA ratio is beneficial for international comparisons as it ignores the distorting effects of individual countries' taxation policies.

- It is also employed to find attractive takeover candidates since enterprise value includes debt and is thus a much better metric than the market cap for mergers and acquisitions (M & M & M&A). An organization with a low EV/EBITDA ratio will be viewed as a decent takeover candidate.

source: Bloomberg.com

- EV/EBITDA ratios vary based on the type of business. So this multiple should be compared only among similar businesses or to the average business generally. Expect higher EV/EBITDA ratios in high-growth industries, like biotech, and lower multiples in industries with slow growth, like railways.

- The EV/EBITDA ratio inherently includes assets, debt, and equity in its analysis as it includes the enterprise value and Earnings before Interest, Taxes, Depreciation, and Amortization values.

- An organization's EV/EBITDA ratio perfectly depicts total business performance. Equity analysts often use the EV/EBITDA ratio when making investment choices.

For example, Denbury Resources INC., an oil and gas company primarily based in the US, reported its first-quarter financial performance on the 24th of June, 2016. Analysts derived and calculated the organization’s EV/EBITDA ratio. Denbury Resources had an adjusted EV/EBITA ratio of 5x. It had a forward EV/EBITDA ratio of 13x. Each of those EV/EBITDA ratios is compared to alternative organizations with similar business and past organization multiples. The organization's forward EV/EBITDA ratio of 13x was more than double the enterprise value at the same point in time in 2015. Analysts found that the increase was because of an expected decline in the organization's EBITDA by 62%.

Limitations of EV/EBITDA

EV/EBITDA ratio is a good ratio that stands above other traditional techniques similar to it. However, it does have certain drawbacks, which have to be known before using this metric to make sure you are less affected by them. The main drawback is the presence of EBITDA in the ratio.

Here are some of the EBITDA’s drawbacks:

- EBITDA is a non-GAAP measure that allows greater discretion on what is and what is not added within the calculation. It also implies that organizations usually modify the things included in their EBITDA calculations from one reporting period to the other.

- EBITDA initially came into common use with leveraged buyouts in the Eighties. At that time, it had been employed to indicate the ability of an organization to service debt. It became widespread in industries with expensive assets that had to be written down over long periods. EBITDA is commonly quoted by several firms, particularly within the tech—sector — even when it is not secured.

- A common misconception is that EBITDA represents cash earnings. Although EBITDA is a smart metric to judge profitability, it is not a measure of cash income. EBITDA also leaves out the money needed to fund the working capital and replace previous equipment, which might be vital. Consequently, EBITDA is commonly used as an accounting gimmick to dress up a company's earnings. When using this metric, it is vital that investors also look at alternative performance measures to ensure that the organization isn’t attempting to hide something with the EBITDA value.

Which sectors are best suited for valuation using EV to EBITDA

Generally, you can use the EV to EBITDA valuation method to value capital intensive sectors like the following -

- Oil & Gas Sector

- Automobile Sector

- Cement Sector

- Steel Sector

- Energy Companies

However, EV/EBITDA cannot be used when the current cash flow is negative.

Alternative to EBITDA

There is something called the adjusted EBITDA in accounting vocabulary, which can be a better alternative to EBITDA because of having fewer drawbacks. Adjusted EBITDA is a metric for an organization that adjusts its "top line" earnings for extraordinary items before deducting interest expenses, taxes, and depreciation charges. It is often employed to compare similar firms and for valuation.

By standardizing cash flows and discounting anomalies, which might occur, be adjusted, or be normalized, EBITDA can give a better measure of comparison while evaluating multiple organizations. Adjusted EBITDA differs from EBITDA in that adjusted EBITDA normalizes financial gains and expenses since different organizations might treat each kind of financial gain and expense differently. The adjusted EBITDA can be expressed in a formula as follows:

The adjusted EBITDA can be expressed in a formula as follows:

Adjusted EBITDA = Net Income – Other Income + Interest + Taxes + Depreciation & Amortization + Other Non recurring charges

So when it comes to calculating the EV/EBITDA ratio for a business organization, the use of EBITDA value can be replaced by the use of adjusted EBITDA value. The change is preferable as the adjusted EBITDA value has more accuracy than the simple EBITDA value.

Below is a snapshot of Square's Adjusted EBITDA reported in its S1 registration document.

source: Square SEC Filings

Conclusion

EV/EBITDA ratio is an essential and widely used metric to analyze a company's Total Value. This metric has successfully solved the problems encountered while using the traditional metrics, like the PE ratio, and hence it is preferred over them.

Also, as this ratio is capital-structure-neutral, it can be effectively used to compare organizations with different ranges of leverage, which was not possible in simpler ratios.